Introduction

In the high-stakes world of investment banking and private equity, the "analyst bullpen" is notorious for a specific reason: the endless hours spent manually formatting slides, aligning logos, and drafting repetitive sections of Confidential Information Memorandums (CIMs). While the strategic value of a deal is high, the mechanical process of documenting it remains inefficient and prone to human error.

Stansa addresses this operational bottleneck directly. It is an AI-driven platform purpose-built for the financial sector, designed to automate the creation of complex financial documents and presentations. By integrating generative AI into the specific workflows of deal-making, Stansa aims to liberate analysts and associates from low-value drudgery, allowing them to focus on financial analysis and strategic advisory.

What Stansa Does

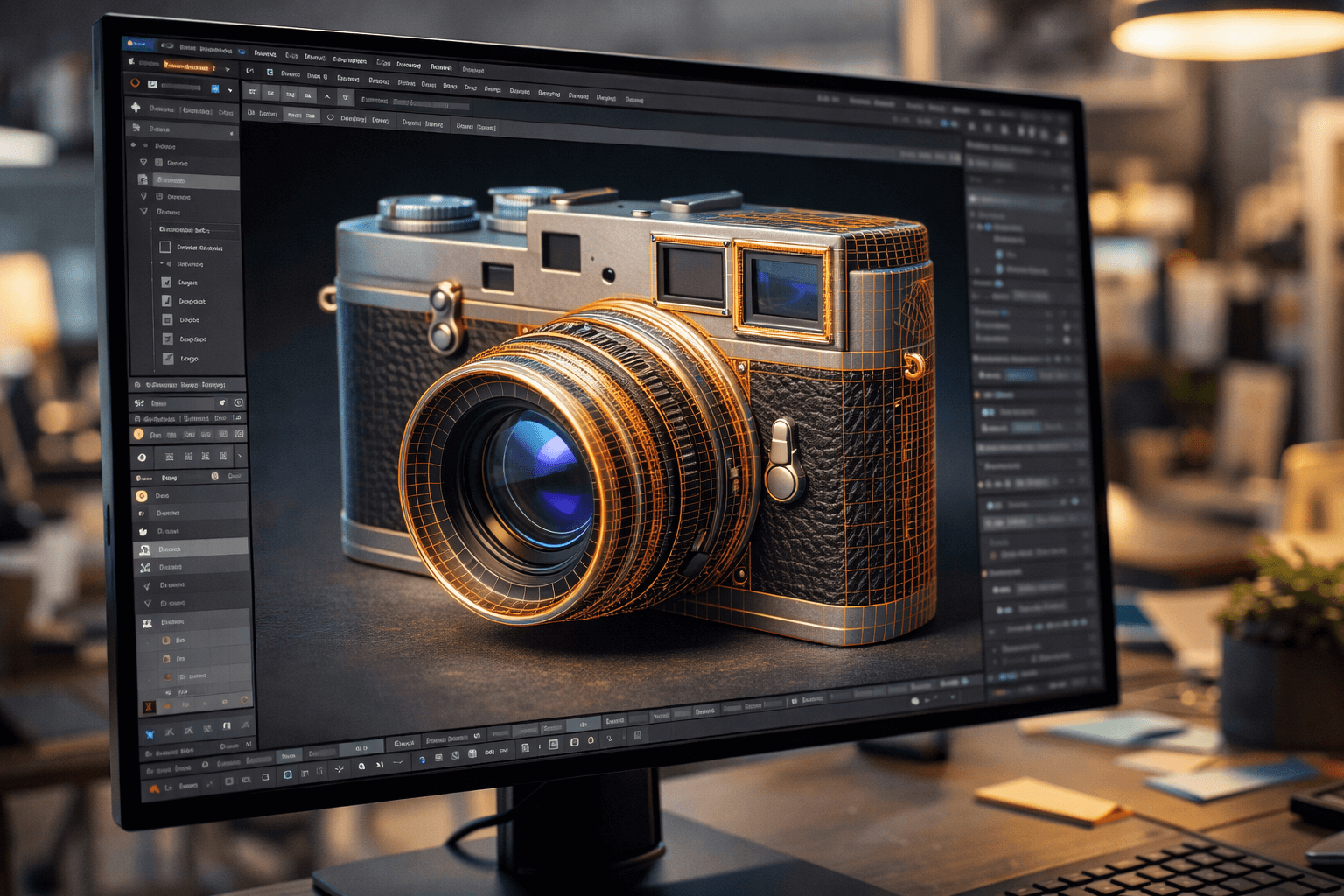

Stansa functions as an intelligent layer on top of the standard investment banking toolkit (primarily Microsoft PowerPoint and Word). Unlike generic AI writing tools, Stansa is trained on the nuances of financial language, deal structures, and institutional formatting requirements.

The platform ingests raw data and instructions to generate near-complete drafts of essential deal documents. Whether it is a pitch deck for a potential IPO, a management presentation, or a text-heavy memorandum, Stansa constructs the narrative and layout simultaneously. It transforms the role of the junior banker from a "compiler of information" to a "reviewer of strategy," significantly compressing the timeline between deal origination and execution.

Key Features and Capabilities

- Automated Pitch Book Generation: Stansa can generate entire slide decks, including standard banking layouts like market overviews, buyer landscapes, and company profiles, adhering strictly to the firm’s branding guidelines.

- CIM Drafting: The platform excels at long-form text generation, capable of drafting sections of Confidential Information Memorandums by synthesizing company data and market research into professional investment prose.

- Financial Context Awareness: Unlike generalist LLMs, Stansa understands financial terminology and context, ensuring that descriptions of EBITDA adjustments or market positioning are accurate and tone-appropriate.

- Brand & Style Compliance: One of the biggest friction points in banking is formatting. Stansa ensures that every font, color, and margin aligns with the bank’s rigorous compliance and design standards automatically.

- Seamless Office Integration: The tool integrates directly into the workflows where bankers live, minimizing the need to switch contexts between a web browser and the Office suite.

Use Cases and Practical Applications

Stansa is currently being deployed to streamline critical stages of the deal lifecycle:

M&A Pitching and Origination

When a Managing Director calls for a pitch deck on a tight deadline, analysts can use Stansa to generate the foundational slides—such as industry trends and potential buyer lists—in minutes rather than hours. This speed allows the team to iterate on the strategic angle of the pitch rather than stressing over formatting.

Private Equity Due Diligence

PE associates often need to synthesize vast amounts of data into investment committee memos. Stansa can draft these memos by pulling relevant information and structuring it into a coherent narrative, accelerating the internal approval process.

Deal Execution and Roadshows

During live deals, the volume of documentation explodes. Stansa assists in maintaining consistency across management presentations and analyst presentations, ensuring that updates to the deal narrative are reflected across all collateral efficiently.

Why Stansa Stands Out

The primary differentiator for Stansa is its vertical focus. While tools like Microsoft Copilot offer broad assistance, they often lack the "domain specificity" required for high-end finance. An investment bank cannot afford hallucinations regarding market data or casual language in a formal CIM.

Stansa distinguishes itself by enforcing the rigor, tone, and precision required by institutional finance. It bridges the gap between raw generative capability and the strict constraints of a compliance-heavy industry. By focusing exclusively on the needs of bankers and investors, Stansa is building a moat based on workflow depth and trust, rather than just raw model performance.

Conclusion

The financial services industry is at a tipping point regarding AI adoption. Stansa represents the future of the modern investment bank—one where efficiency is not measured by how late the lights stay on, but by the speed and quality of strategic insight. For firms looking to retain top talent and increase deal velocity, adopting specialized automation infrastructure like Stansa is becoming a competitive necessity.

Share your startup idea on StartupIdeasAI.com to get discovered by founders, investors, and innovators.

Frequently Asked Questions

Is Stansa secure for confidential client data?

Yes, security is a foundational element of Stansa’s architecture. Designed for institutional use, it adheres to enterprise-grade data privacy standards to ensure client confidentiality is never compromised.

Can Stansa replace investment banking analysts?

No. Stansa is designed to augment analysts by removing repetitive formatting and drafting tasks. This allows analysts to function more like associates, focusing on financial modeling, valuation, and strategy.

Does it work with existing corporate templates?

Absolutely. Stansa is built to ingest and strictly adhere to a firm’s specific PowerPoint and Word templates, ensuring all output is brand-compliant and ready for client presentation.

What types of documents can it create?

It specializes in Pitch Books (decks), Confidential Information Memorandums (CIMs), Teasers, Management Presentations, and Investment Committee Memos.

How does it handle financial data?

Stansa is trained to interpret and present financial data contextually, though it primarily focuses on the narrative and structural presentation of that data within documents.